Want a higher interest rate on your savings and hassle-free? No need to switch your salary-crediting account, maintain a minimum credit card spend, invest nor make a minimum number of bill payment

With new requirements imposed on banks these days to strengthen their balance sheet and liquidity, banks require stickier retail deposits than ever before to fund their loan business.

Hence we are seeing a new generation of saving accounts with bonus interest rates if you tie your transactions to these accounts. Such transactions include bill payments, salary credits, credit card spends, investments and insurance purchases.

As a result of the recent changes and coupled with the near-zero interest rate environment right now, the traditional deposit accounts that you have been maintaining since years ago are paying almost zero interest. These deposits are not deemed as sticky to the banks anymore.

Fuss-free Bank Saving Accounts

The banks are revising their account conditions so regularly these days, especially the saving rates, that ascertaining the best saving account that suits ourselves is not as easy as ABC.

The 2 accounts mentioned below are probably the remaining bank accounts that impose simpler requirements in return for slightly higher interest rates, for now.

Other similar accounts with even lower savings rates are not mentioned here. Rates quoted herein are as at 20 November 2020.

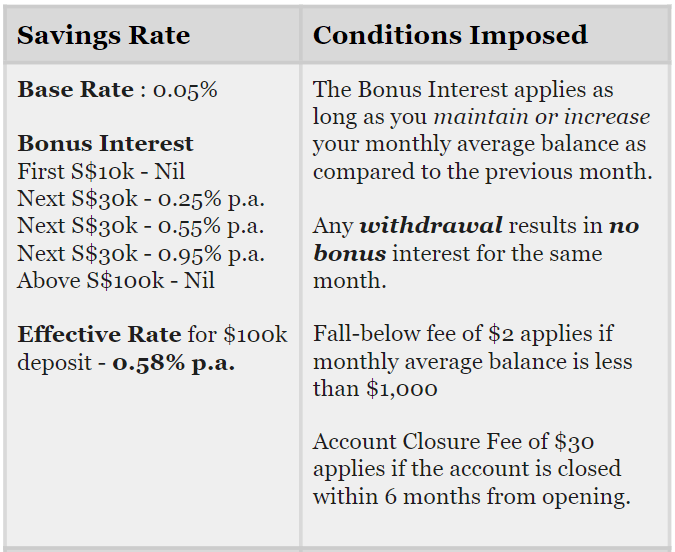

UOB Stash Account

Consider the UOB Stash Account if you have more than funds lying around in a traditional low interest yielding bank account. Especially if you prefer hassle-free low-risk accounts. Do note that the effective rate for $100k is 0.58% p.a. It is not 1% because amount less than $70k attracts lower interest rates.

These should also be funds that you are not going to utilise in the near future. Any withdrawal from the Stash Account will result in zero bonus interest accorded in the same month.

Apply for UOB Stash Account via SingSaver now to get:

S$80 cash credit for the first 200 new account holders who deposit and maintain minimum S$5,000;

S$40 cash credit for the first 200 existing UOB account holders who open a new UOB Stash account, deposit and maintain minimum S$5,000

Promotion ends on 30 Apr 2021.

If you have beyond $100k, you may want to consider opening another account elsewhere say CIMB since any additional funds beyond $100k are going to earn a near-zero 0.05% base interest rate.

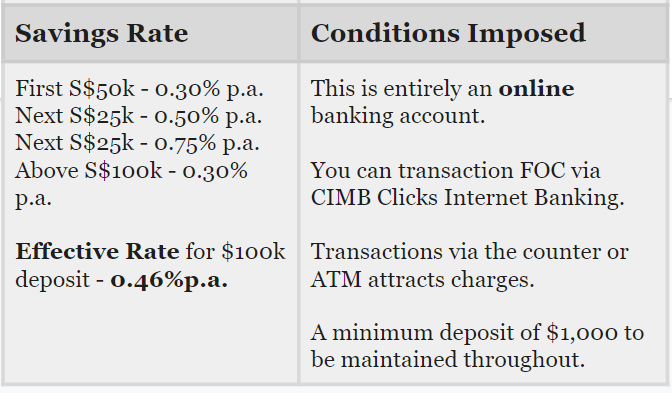

CIMB Fastsaver Account

The CIMB Fastsaver Account will give your savings a little more decent returns too. Moreover, the bank welcomes you to deposit more than $100k by giving you 0.3%p.a. for the extras. UOB does not give any interest for funds above $100k.

There is a lot more freedom when it comes to transacting from this account. You will still be accorded the tiered interest even if you need to withdraw from the account.

However, to deposit into or withdraw from the account over the counter, there will be a $5 fee incurred per transaction. The transaction is free if carried out via internet banking and cheque. Thus, you have to be comfortable with using internet banking in order to maximize your returns from this CIMB Fastsaver Account.

So, if you need to keep your funds in bank accounts with minimum maintenance and yet earn a little more interest than near zero, UOB Stash Account and the CIMB Fastsaver are the ones to go for now.

You may be interested in these posts too:

6 Best Cashback Credit Cards for Online Grocery Shopping– 2020

Top Exciting Places Your Kids will Love to this December Holiday!

Going to the Jurassic Mile at Changi Airport with 2 three-year-olds

Clenzd – Powerful Food-Grade Sanitizer That Eliminates 99.999% Of Viruses And Bacteria!

Get $300 Cashback Gift with DBS/POSB Credit Cards

Lion City Bike Tour – Get to Know Singapore the Unique Way

*This post contains affiliate links at no additional cost to you.